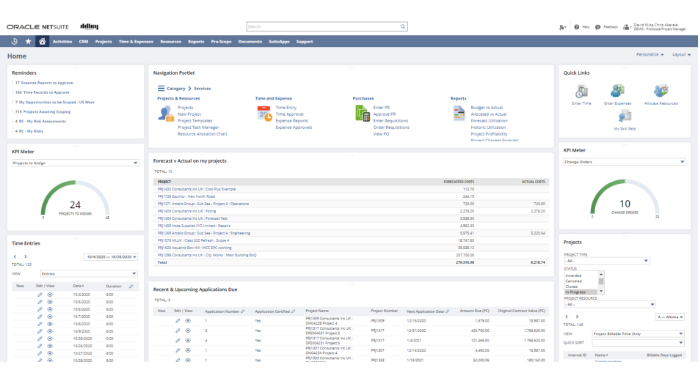

Watch a demo of CIS processing:

Construction Industry Scheme (CIS)

Under the Construction Industry Scheme (CIS), contractors deduct money from a subcontractor’s payments and pass it to HMRC.

The deductions count as advance payments towards the subcontractor’s tax and National Insurance.

Contractors must register for the scheme. Subcontractors do not have to register, but deductions are taken from their payments at a higher rate if they’re not registered.

ProScope is the only native CIS module for NetSuite that is registered with HMRC that enables CIS submissions at the click of a button.

Can ProScope verify subcontractors online?

Yes, ProScope is recognised by HMRC as providing online verification requests and makes this procedure very straightforward. Simply enter the details of a subcontractor into ProScope’s supplier list (their Unique Taxpayer Reference number and National Insurance number) and at the click of a button, the corresponding verification number and tax status is returned by HMRC.

Are subcontractor deductions calculated automatically?

Once a subcontractor is verified, using the data from HMRC, ProScope will automatically calculate the correct level of deductions to be made. The Construction Industry Scheme (CIS) deduction rates are:

- 20% for registered subcontractors

- 30% for unregistered subcontractors

- 0% if the subcontractor has ‘gross payment’ status - for example they do not have deductions made.

You must pay these deductions to HMRC - they count as advance payments towards the subcontractor’s tax and National Insurance bill.

Does ProScope allow me to submit monthly returns to HMRC?

As the deductions are automatically calculated for each subcontractor, ProScope collates this information into a single report (CIS 300 report) and this can be submitted electronically to HMRC at the end of each month at the click of a button. There’s no need to pull this data from external spreadsheets or manually calculate figures, the entire process is automated.

Can I prepare subcontractor statements?

CIS requires that subcontractors are provided with a CIS payment and deduction statement within 14 days of the end of the tax month in which the payment was made. This is the written evidence which the subcontractor can use to prove any tax deductions with HMRC. ProScope allows you to generate PDF statements which can be emailed to your subcontractors directly from NetSuite keeping everything in a single source, will a full audit trail.

Is ProScope endorsed by HMRC?

While HMRC don’t endorse any particular suppliers’ solution, all solutions must be demonstrated to work to the current CIS requirements and ProScope has been ‘recognised’ as just such a solution and can be found on the HMRC’s list of approved software providers.

Is ProScope up to date with all CIS legislation changes?

Yes, as it is cloud-based, and communicated directly with HMRC, any changes in rates or legislation will automatically be applied to transactions.

Is ProScope compatible with all versions of NetSuite?

Yes, ProScope will support all versions of NetSuite.

Control Your Costs & Maximise Your Profit

Every process of the construction project lifecycle is accounted for within ProScope – from tendering, to procurement, inventory control, payments and progress claims, retentions. Enabling the most effective use of critical resources by minimising waste through proper planning management, task execution and workflow oversight to achieve profitability.

Get in touch to arrange a demo of ProScope for NetSuite