CALCULATIONS, BILLING, AND SUBMISSIONS MADE SIMPLE

Construction Industry Scheme (CIS) in NetSuite

Easily manage contractor statuses, view reports (including withheld payments), and process your CIS submissions directly to HMRC’s Government Gateway completely within NetSuite. ProScope is the only native Construction Industry Scheme (CIS) module that is registered with HMRC to enable CIS submissions at the click of a button.

Streamlined, accurate, and compliant payments and submissions every time.

Remove the need for multiple systems, complex spreadsheets, and hours of manual processes every month. Built by industry experts, ProScope unifies all project, contractor, and payment data within NetSuite, eliminating the most common frustrations and challenges of managing CIS payments and submissions.

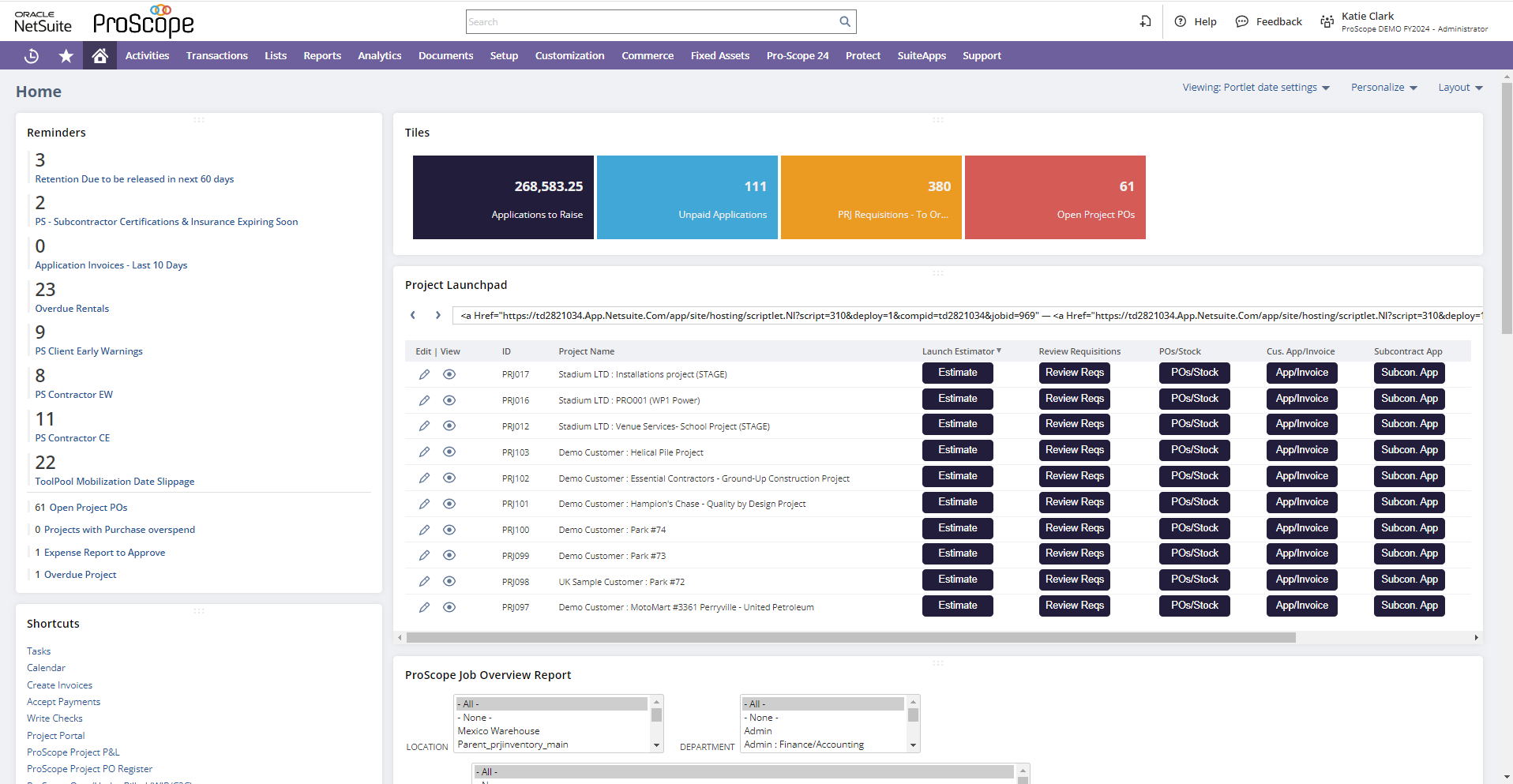

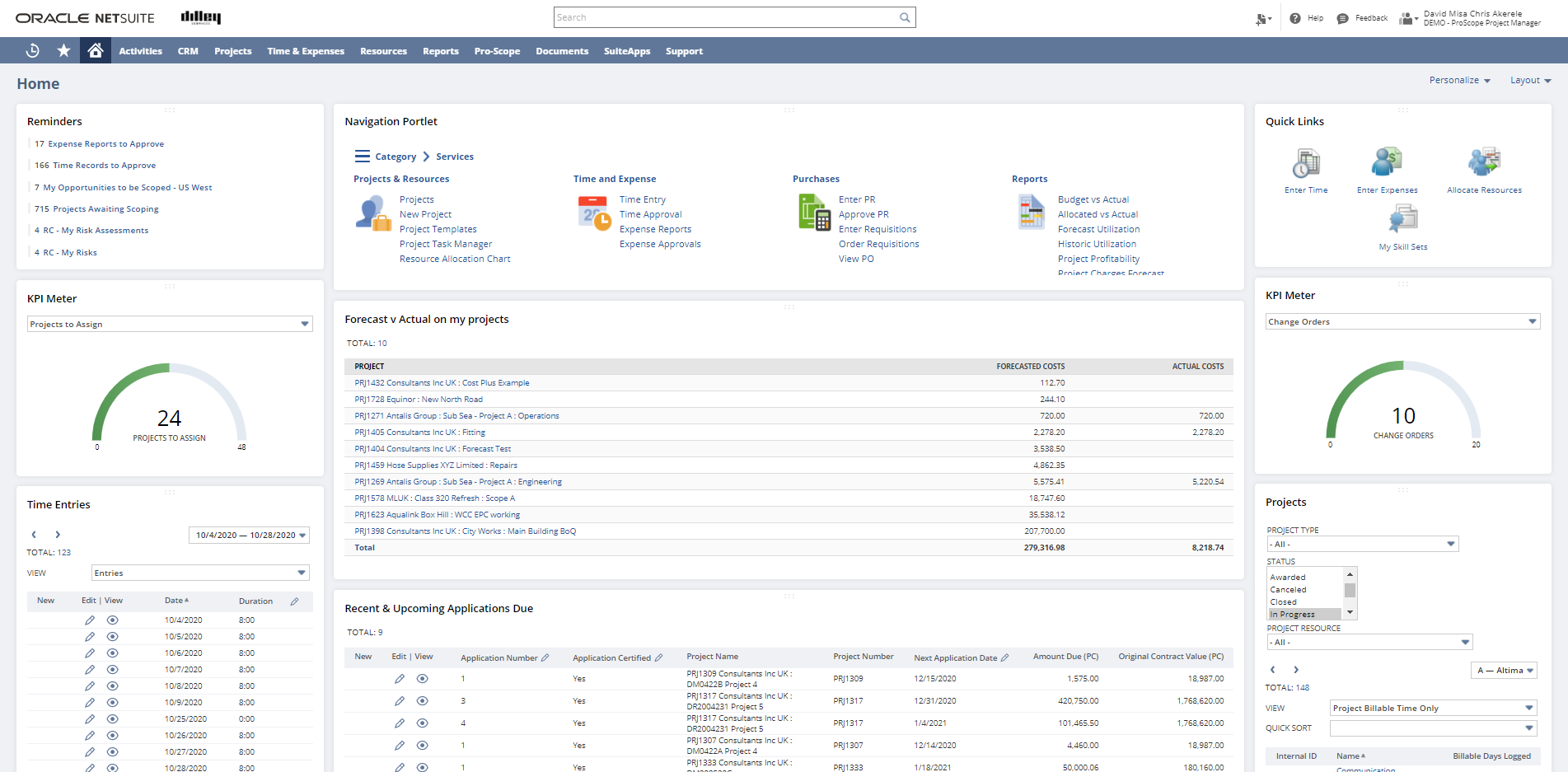

One Single Platform for All Project & Payment Data

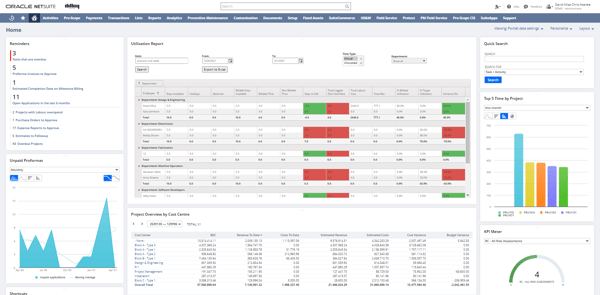

Live Visibility of All Contractor & Payment Statuses

Compliant Reporting & Seamless Submissions

Native to NetSuite

Manage everything easily in one system

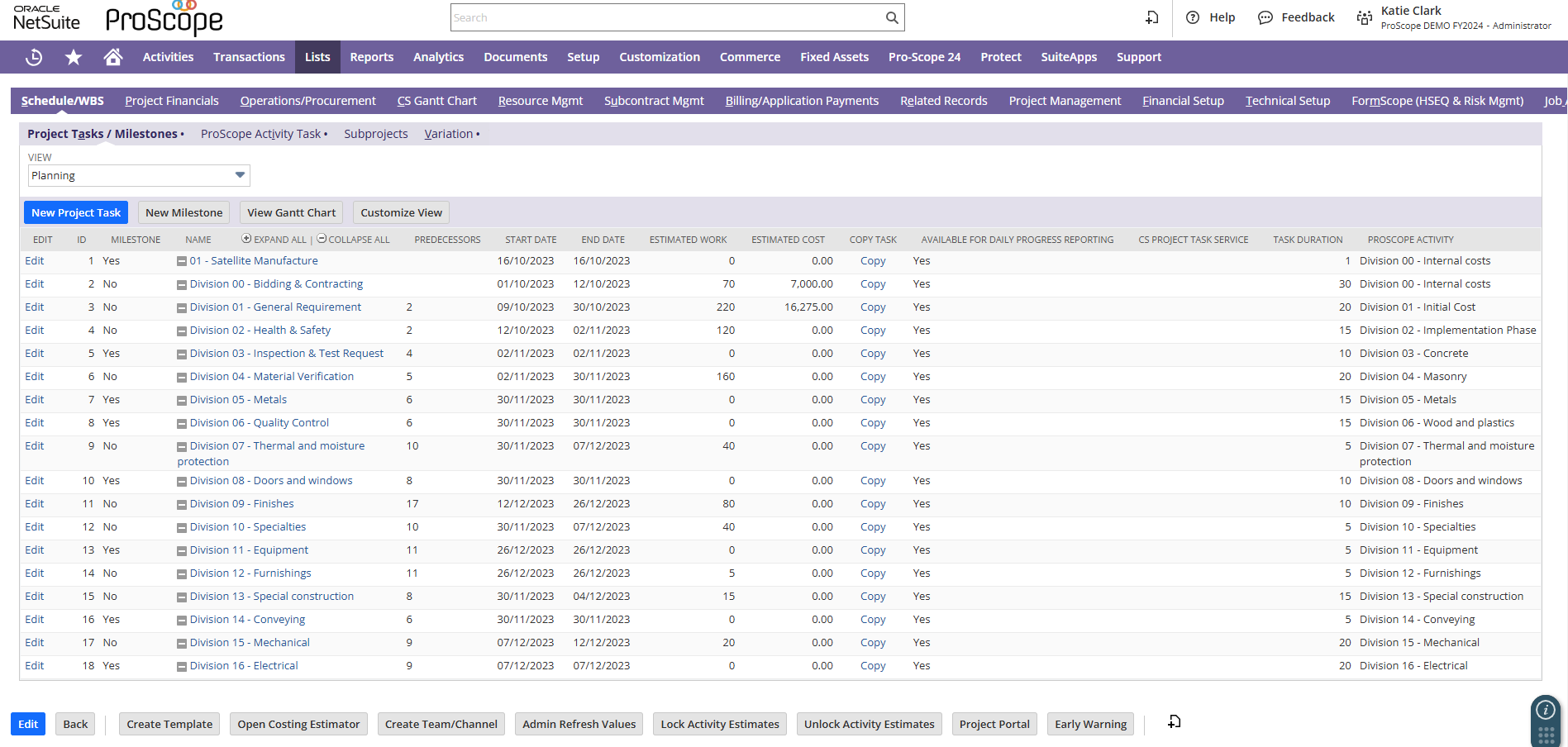

A single source of truth to manage your entire CIS payments and submissions process. Built within NetSuite, ProScope extends the core database and records to incorporate everything from contractor status to withheld payment information within your core supplier and transaction records. This removes the need for unnecessary spreadsheets and duplicate entry whilst ensuring correct payments and complete visibility.

Easily Verify Subcontractor Status

Accurate payments driven by the supplier details

Integrating directly to HMRC’s Government Gateway, you can electronically verify a contractor’s status directly from your supplier list in NetSuite, including the automated population of their verification number and withheld tax code (nett, gross, unmatched).

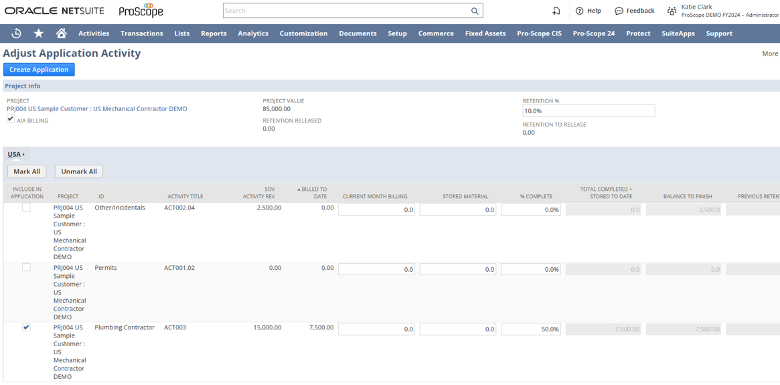

Automate CIS Calculations

Never miss a payment

Generate accurate CIS calculations in one system within a few clicks. By unifying contractor and subcontractor status information with all other project data (including materials, services and withheld payment information), ProScope automatically calculates the correct CIS payments every time, without needing to leave NetSuite. So, you remain completely compliant, your payments are accurate and timely, and your contractors are happy.

View our On-Demand Demo

NetSuite CIS Reporting

Complete visibility within your core finance system

With no duplicate entry or spreadsheets - quickly and accurately view and track amounts withheld by contractor and vendor bills, including vendor-specific statements, meaning you can easily keep on top of your CIS reporting requirements.

Seamless HMRC submissions

No additional clicks, interfaces, or errors

Process CIS submissions directly from NetSuite to the Government Gateway to ensure a simple, secure, compliant, and painless process. Plus, you can relax knowing that all information is accurate and easily traced with electronic receipts to guarantee a full audit trail.

.jpeg?width=1000&height=667&name=solar-windfarm(3.2).jpeg)

.webp?width=400&height=335&name=Website%20Quote%20Images%20(3).webp)

Resources

Blog

Case Study

.jpg?width=2000&height=1125&name=ProScope%20Resource%20Images%20(1).jpg)